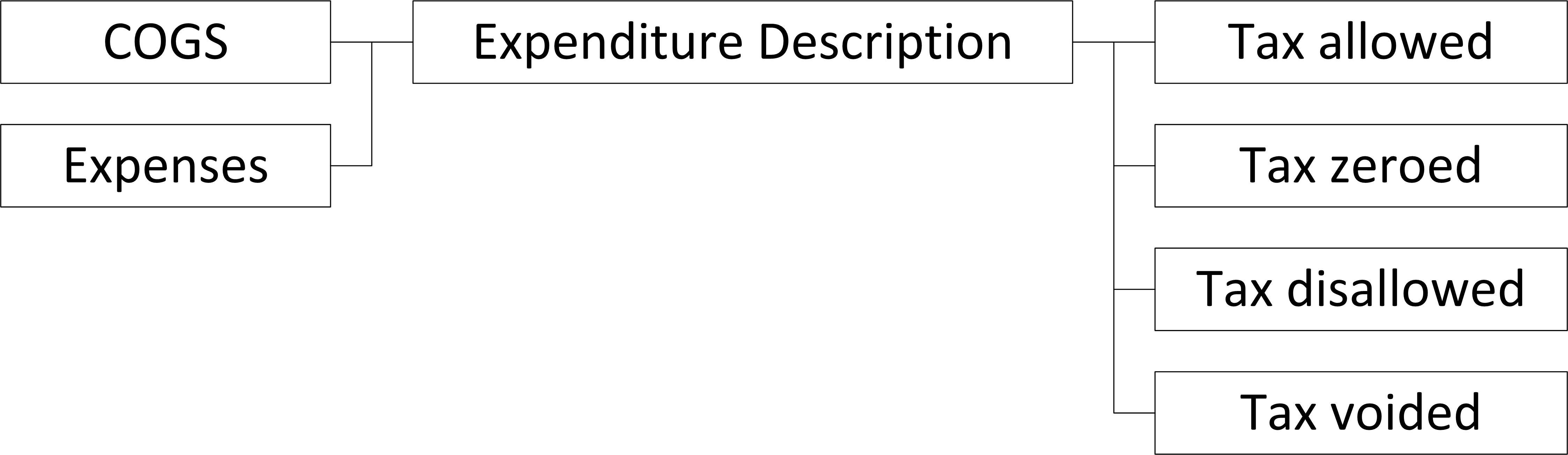

Types Definition

Transaction types

|

Type is defined for the accounting and bookkeeping system to recognize the transactions to be posted to the respective financial reports.

|

|

|

|

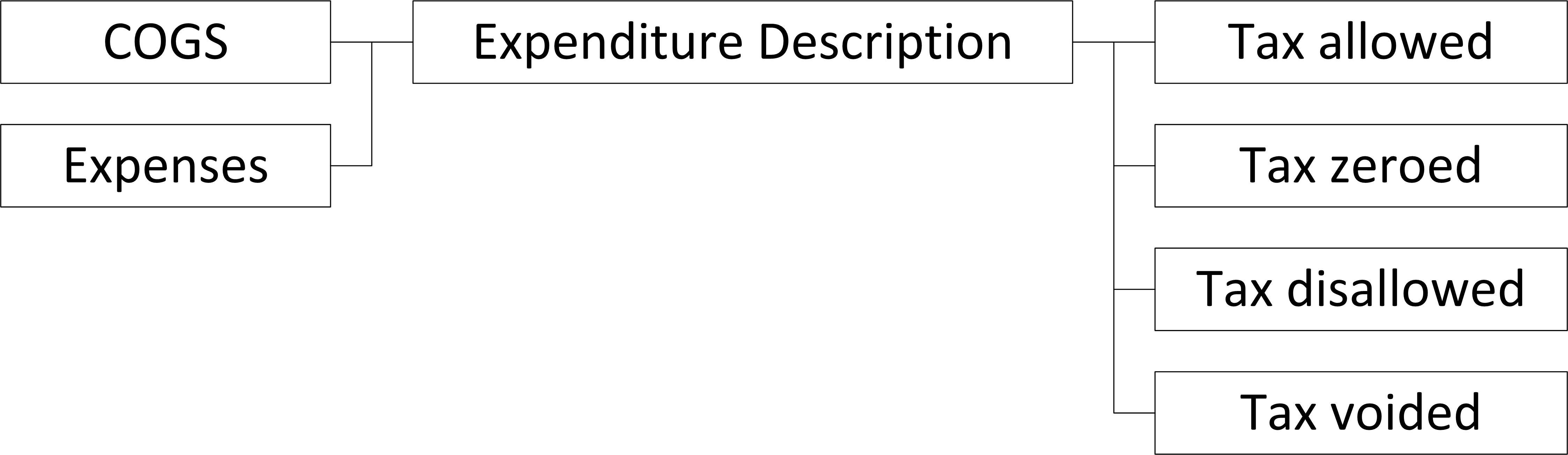

Types Definition

Transaction types

|

Type is defined for the accounting and bookkeeping system to recognize the transactions to be posted to the respective financial reports.

|

|

|

|