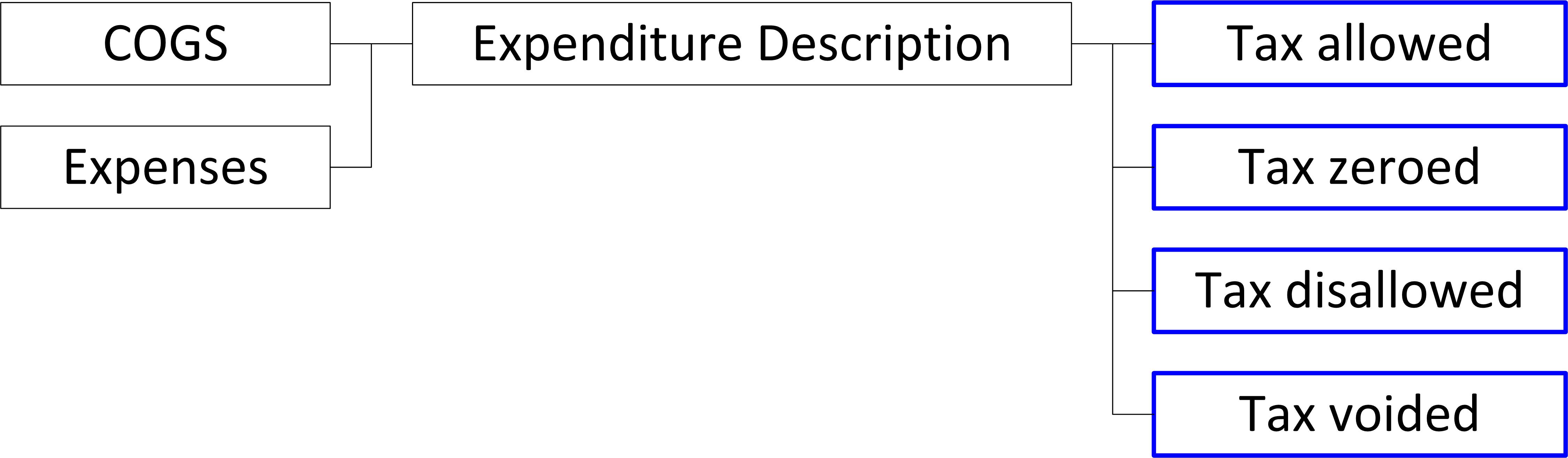

Types Definition

Transaction types

GSTR category

|

|

|

Tax allowed |

|

Tax zeroed |

|

Tax disallowed |

|

No tax |

| Type | Description |

|

|