Types Definition

Transaction types

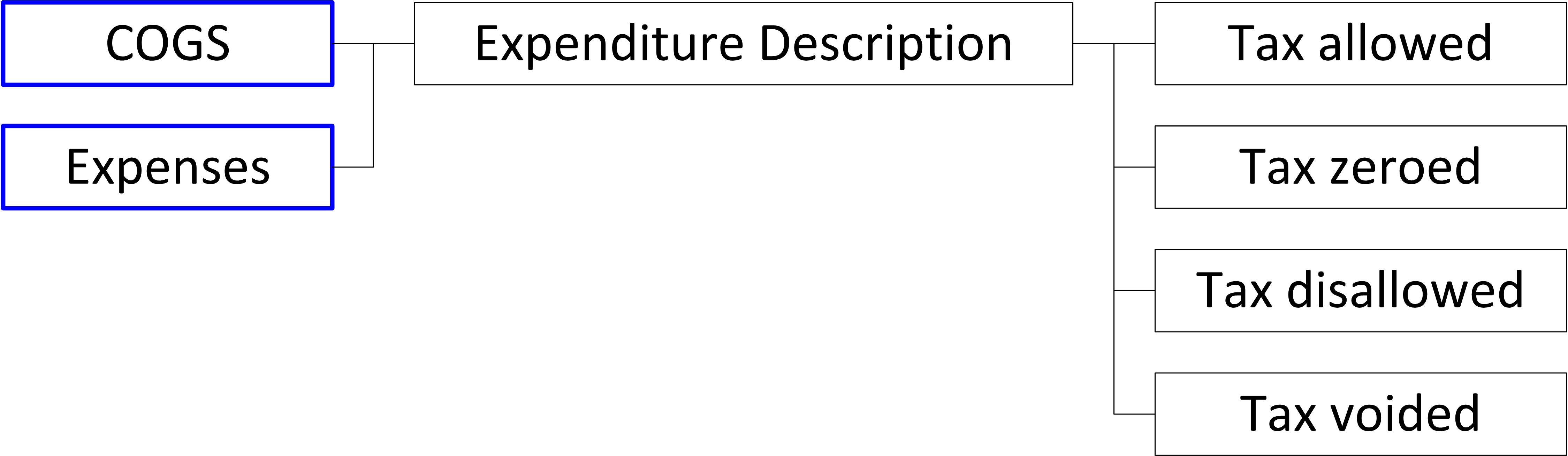

P&L category

|

This category is based on the Profit & Loss statement. Under the report, they are Sales profit, Cost of Goods Sold, and Expenses. All figures are the cost of the transactions before the GST tax. The GST tax will be handled in Goods & Services Tax Returns category

|

| Type | Description |

|

|